INTRODUCTION

Venezuelan Fundamentals

This is a section on the Venezuelan economic fundamentals.

This section looks at the current situation of the Venezuelan economy. It summarizes available reliable data of the main aspects of its economy.

As new data arises in the public domain, I will publish in this part of the site and will include comments in the blog to analyze these changes and possible trends.

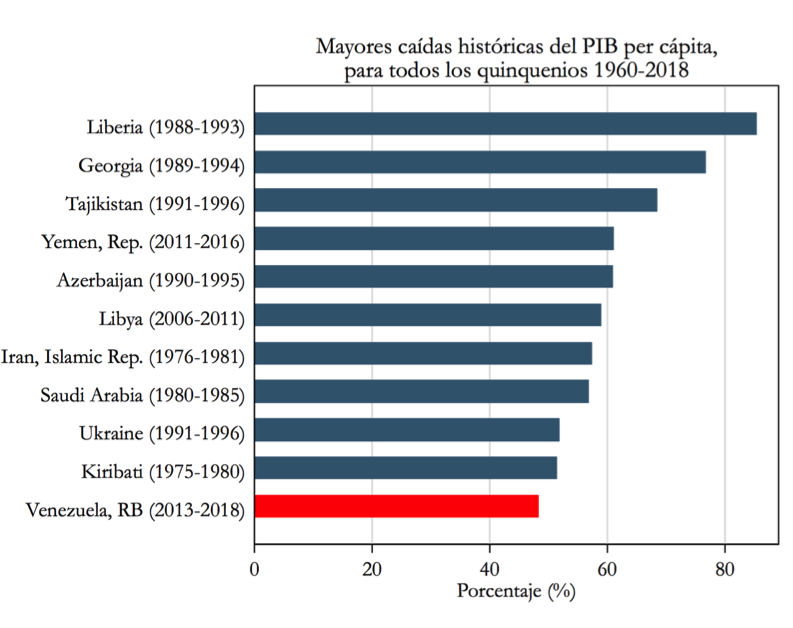

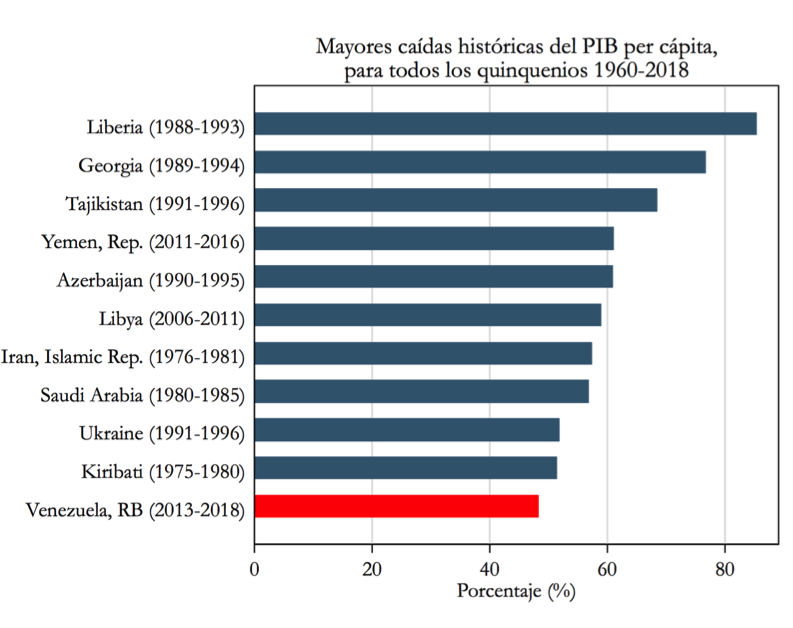

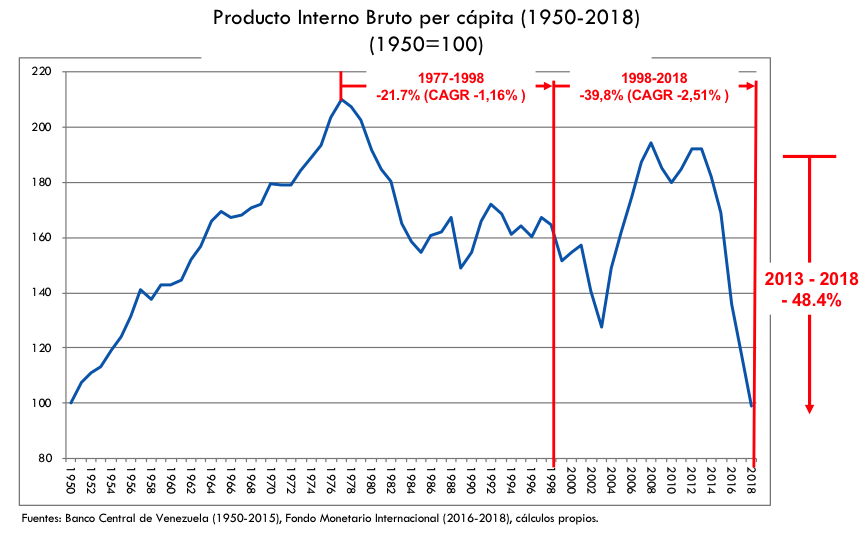

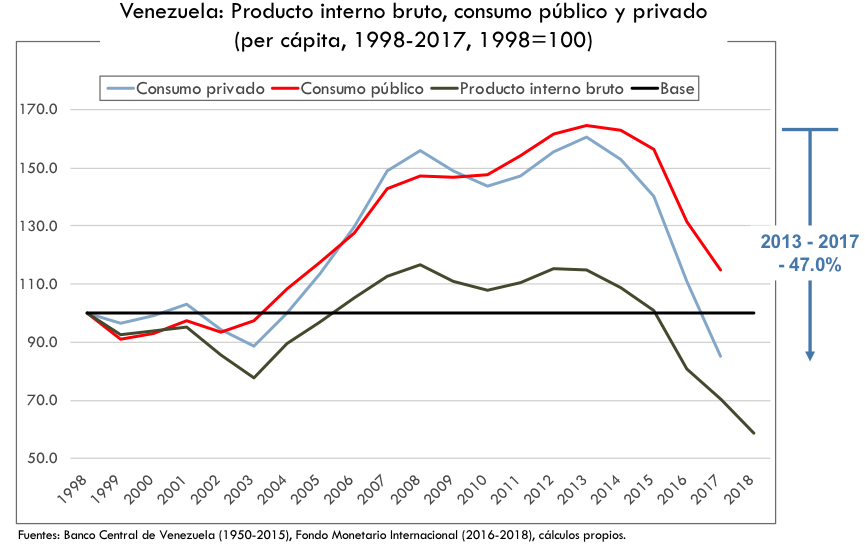

During the last 20 years Venezuelan economy has been poorly managed by economic policies that has devastated the economy. The numbers are clear with ramping inflation and destruction of GDP bringing it to the levels of 1950 (see figure on the right).

In such a situation fine-tune policies don’ t work so we have to go the basics of reconstruction.

Sustainable National Wealth (SNW) can only can come from value creation from investments. All other economic policies like currency measures (eg devaluation) interest rate manipulation etc are only short term measures that artificially can correct economic imbalances. However true wealth can only comes from national production, employment creation, innovation, modern infrastructure, social policies and exports.

Only when efforts are focused on production and utilization of national resources the country would enter in a real economic growth improving citizens life and increasing wellbeing of the Venezuelan people.

Lets then analyze where are the areas where Venezuela is strong and how modern investment model can efficiently use these resources to produce SNW.

Fundamental 1 - Venezuelan strengths and resources

In this section I will try to highlight the most relevant assets and resources Venezuela can use to set the basis for economic growth and value creation

A srtong currency can only be achieved in reality if the country has a strong export economy. This is the only way to have access to foreign currency reserves and attract foreign investments that would protect the local currency and lower inflation. This is how countries like US and Germany have built their economies.

A stable currency and low inflation helps to incentives internal consumption and foster long term investments in the industry, stable mortgages which at the same time improves the accessibility to housing for citizens.

In conclusion the best way to start is to build a diversified economy oriented to exports!

Luckily for Venezuela, it has enough resources to build an export driven economy.

The oil is only one element more. A country cant build its wealth based on a single natural resource. A country must diversified and encourage entrepreneurship in all areas.

In addition to oil, Venezuela has plenty of areas to develop from renewable energy to tourism and metal industry. The potential is enormous.

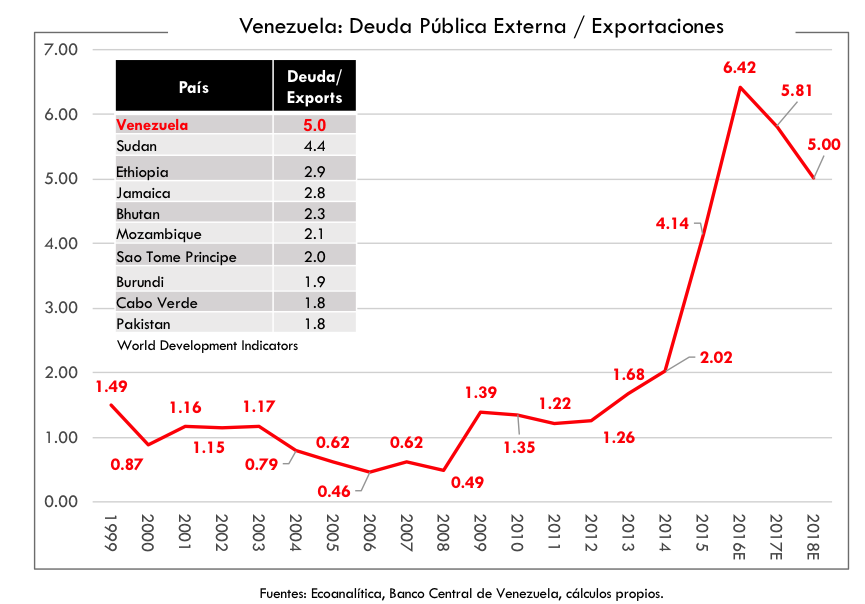

Fundamental 2 - Venezuelan Debt

This section focuses on the Venezuelan debt.

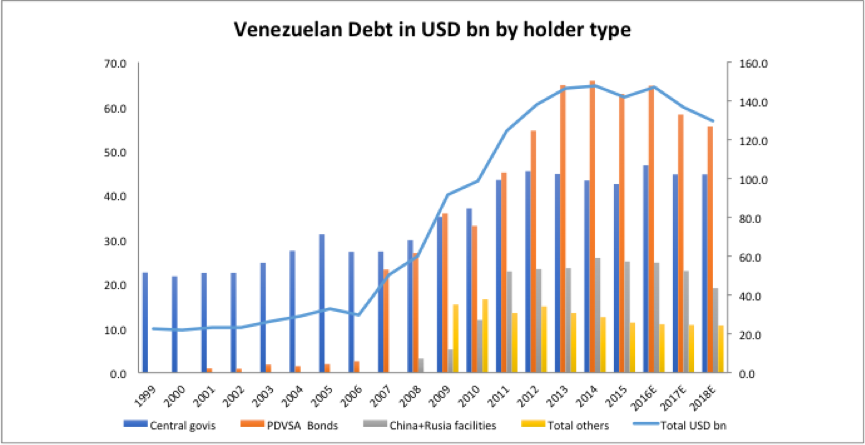

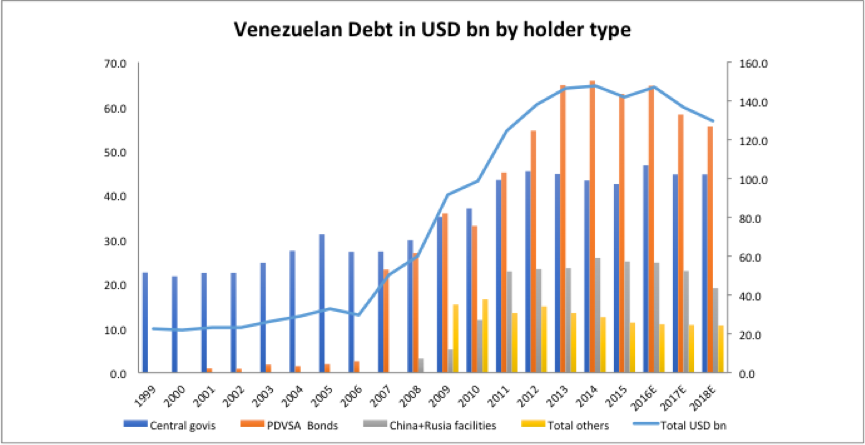

There are two main sources of national debt: (i) Sovereign Bonds and (ii) PDVSA bonds.

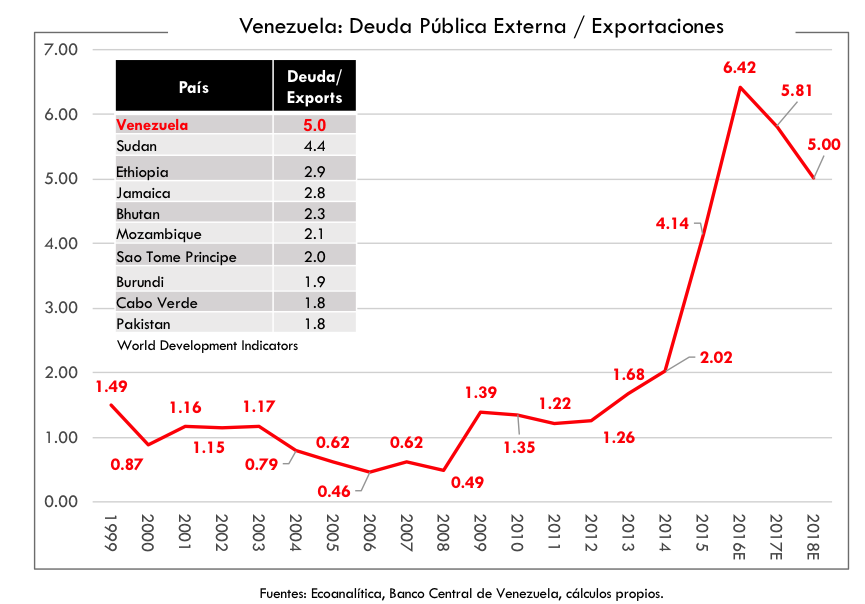

Graph 1 next shows the evolution of Venezuelan national debt since the 1990´s. As can be appreciated before the 2002 Venezuela had a controlled debt where accumulated between 20-30% of national GDP. Since then the debt levels have increased uncontrolled until current levels of 100% of GDP. These levels are considered unsustainable in developed economies like in the case of Japan with 250% or Italy 150%.

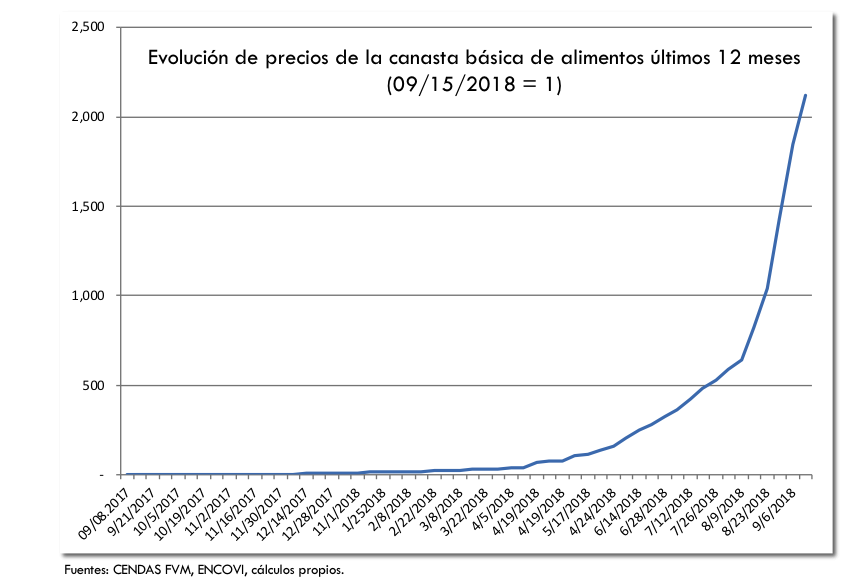

Inflation Venezuela remains out of control.

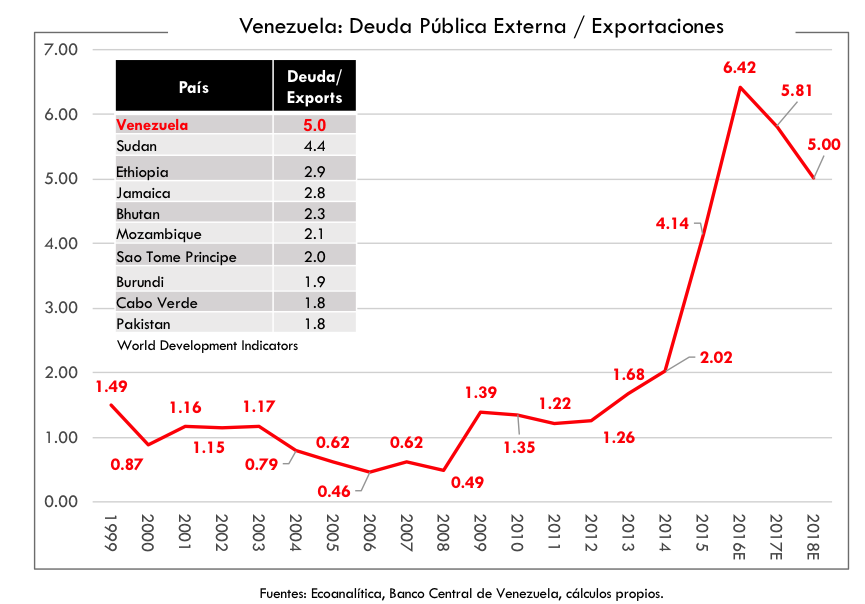

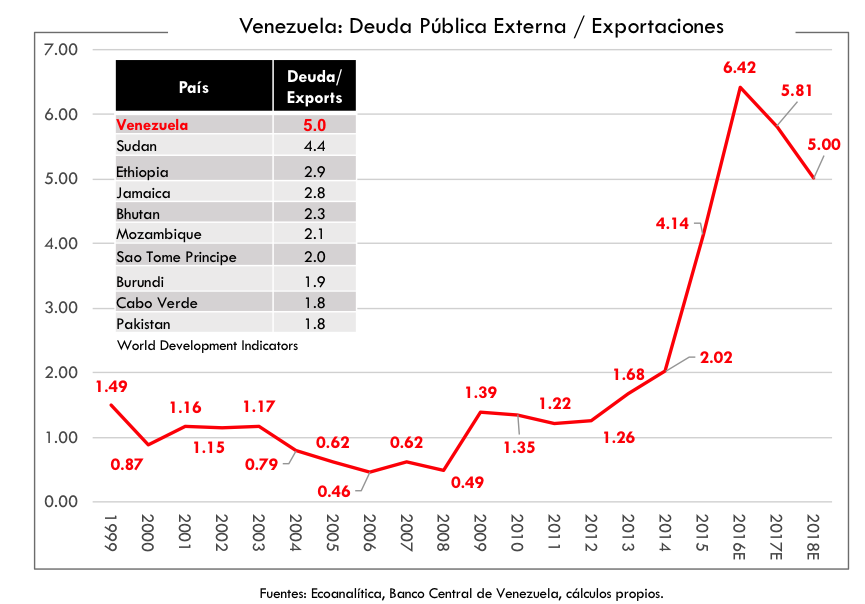

highly dependent on oil revenues, which account for almost all export earnings and nearly half of the government’s revenue, despite a continued decline in oil production in 2017. In the absence of official statistics, foreign experts estimate that GDP contracted 12% in 2017, inflation exceeded 2000%, people faced widespread shortages of consumer goods and medicine, and the central bank’s international reserves dwindled. In late 2017, Venezuela also entered selective default on some of its sovereign and state oil company, Petroleos de Venezuela, S.A., (PDVSA) bonds. Domestic production and industry continues to severely underperform and the Venezuelan Government continues to rely on imports to meet its basic food and consumer goods needs.

Falling oil prices since 2014 have aggravated Venezuela’s economic crisis. Insufficient access to dollars, price controls, and rigid labor regulations have led some US and multinational firms to reduce or shut down their Venezuelan operations. Market uncertainty and PDVSA’s poor cash flow have slowed investment in the petroleum sector, resulting in a decline in oil production.