Definition and trends

PASSION IS RELENTLESS DETERMINATION TO ACHIEVE WHATEVER IS MOST IMPORTANT TO YOU...

Green bonds are a financing technology that offers assets in an investor friendly format that allow them to mobilize capital in favor of climate change. I will bring the latest developments and business cases share knowledge in this asset class.

This financing tool can offer a a good solutions to finance green innovation, infrastructure, industrial production, energy efficiency, etc.

We will start with the basic definition and current available standards from public sources and main case studies…

“The GreenBond market aims to enable and develop the key role that debt markets can play in funding projects that contribute to environmental sustainability. The Green Bond Principles (GBP) promote integrity in the Green Bond market through guidelines that recommend transparency, disclosure and reporting. They are intended for use by market participants and are designed to drive the provision of information needed to increase capital allocation to such projects. With a focus on the use of proceeds, the GBP aim to support issuers in transitioning their business model towards greater environmental sustainability through specific projects.”

green bond standards

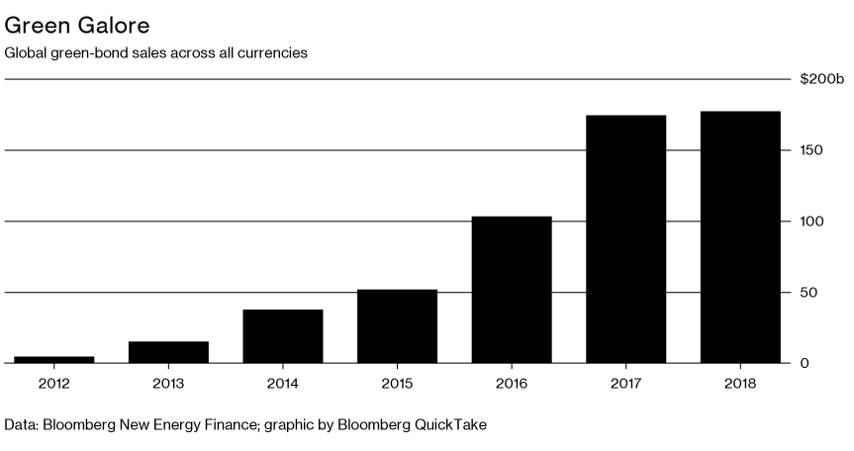

How big is the global green-bond market?

A cumulative $580 billion of green bonds were sold through 2018, according to Bloomberg New Energy Finance. Another $170 billion to $180 billion are likely to be sold in 2019 based on what’s currently happening in the market, BNEF analyst Daniel Shurey says. The market is expected to keep growing, with Europe alone needing about 180 billion euros ($203 billion) of additional investment a year to achieve 2030 emission targets set by the European Union in the 2015 Paris Agreement on climate change. For now, however, green bonds are a tiny fraction of the more than $100 trillion global bond market.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.